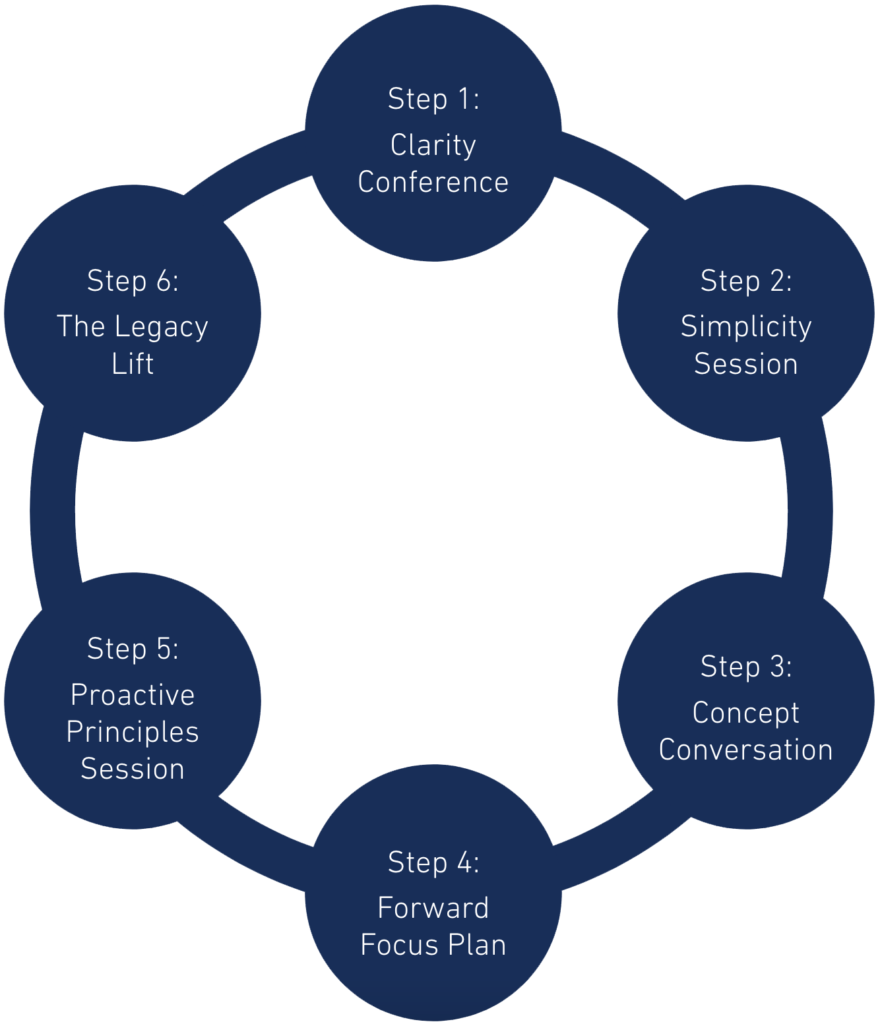

Step 1: Clarity Conference

Our initial meeting is our opportunity to help you live the life you choose. To accomplish this we first have to explore the opportunities and challenges that exist in your life both personally and professionally. Our initial meeting involves an in-depth conversation so we can learn about what’s important to you, your family and the legacy you’d like to build.